Germany's Beiersdorf AG, renowned for its Nivea skincare products, has unveiled plans to initiate a share buyback program worth approximately $525 million. This strategic move is set to commence following the company's annual general meeting in 2025 and is expected to conclude by the end of that year.

Key Takeaways

- Beiersdorf plans to buy back shares worth €500 million ($524.85 million).

- The buyback program is scheduled to start after the 2025 annual general meeting.

- The company had previously completed a similar buyback program in 2024.

- Beiersdorf reported an increase in group sales for the first nine months of 2024.

Overview of Beiersdorf's Financial Strategy

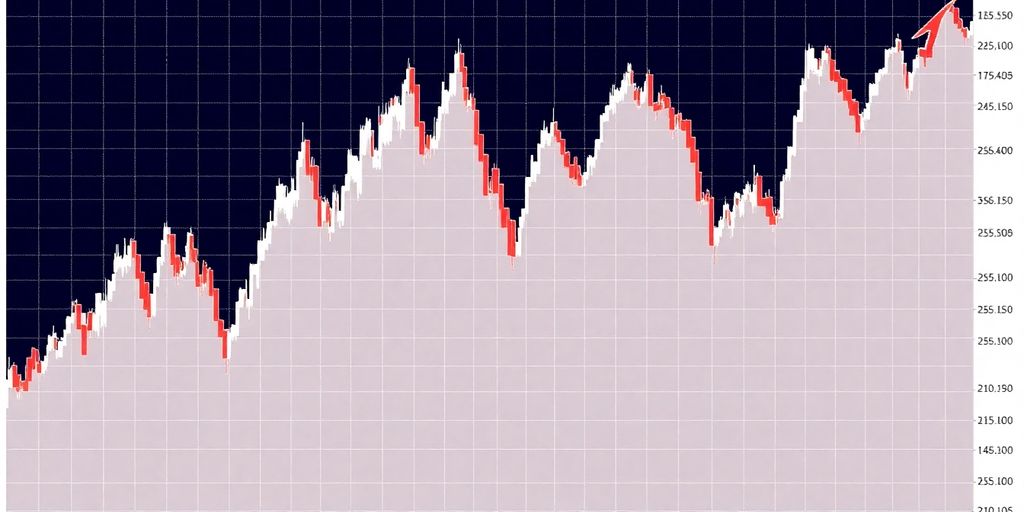

Beiersdorf's decision to embark on this share buyback program reflects its commitment to enhancing shareholder value. By repurchasing shares, the company aims to reduce the number of outstanding shares, which can lead to an increase in earnings per share (EPS) and potentially boost the stock price.

The company had successfully executed a €500 million share buyback program in 2024, indicating a consistent strategy to return capital to shareholders. This approach not only signals confidence in the company's financial health but also serves as a mechanism to manage capital effectively.

Recent Performance and Market Challenges

In its recent financial disclosures, Beiersdorf reported a rise in group sales for the first nine months of 2024. Despite facing challenges in the Chinese luxury market, the company remains optimistic about a strong performance in the fourth quarter. This resilience in sales growth is a positive indicator for investors, especially as the company prepares for its full-year results announcement.

Implications for Shareholders

The upcoming share buyback program is expected to have several implications for Beiersdorf's shareholders:

- Increased Share Value: By reducing the number of shares in circulation, the buyback could lead to a higher share price, benefiting existing shareholders.

- Enhanced Earnings Per Share: With fewer shares outstanding, the company's earnings per share may increase, making the stock more attractive to investors.

- Confidence in Financial Health: The decision to initiate a buyback program often reflects a company's strong financial position and confidence in future growth.

Conclusion

Beiersdorf's announcement of a $525 million share buyback program marks a significant step in its ongoing strategy to enhance shareholder value. As the company navigates market challenges and aims for continued growth, this initiative is likely to be well-received by investors, reinforcing their confidence in Beiersdorf's long-term prospects. With a solid performance in recent quarters, the company is poised to make a positive impact in the financial markets as it moves forward with its plans.

Sources