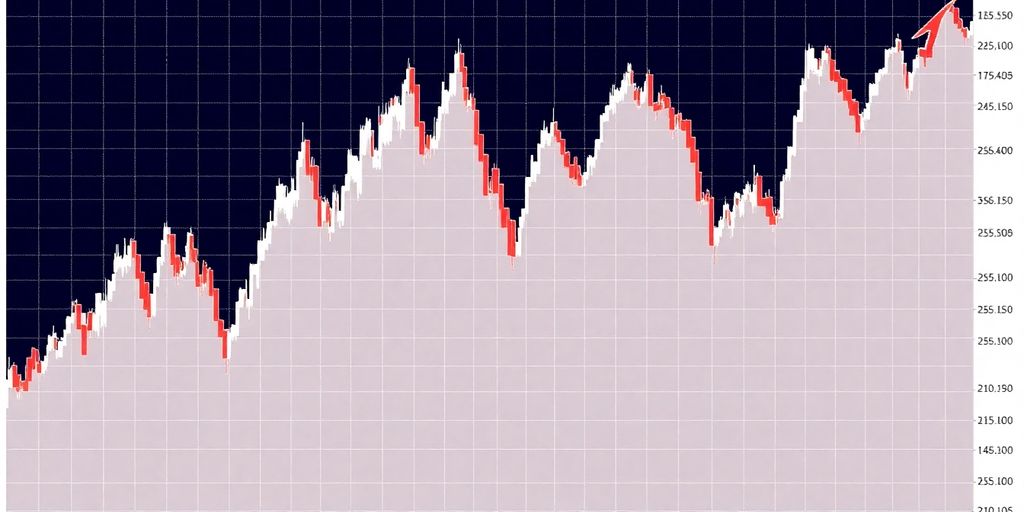

Euronext, the pan-European stock exchange operator, has reported impressive fourth quarter results that exceeded market forecasts. The company recorded a revenue of 415.8 million euros ($431.68 million) for the last three months of 2024, driven by robust fixed income trading and the expansion of its clearing business.

Key Takeaways

- Euronext's revenue for Q4 2024 reached 415.8 million euros, surpassing analyst expectations of 408.8 million euros.

- The growth was fueled by record performance in fixed income trading and strong results from non-trading related businesses.

- Euronext is shifting its business focus towards higher-value custody, settlement, and fixed income trading.

- The European public offerings trend is gaining momentum after a lackluster 2024.

Strong Revenue Growth

Euronext's fourth quarter revenue growth is attributed to several key factors. The company reported a record performance in fixed income trading, which has become a significant part of its business strategy. Additionally, the expansion of its clearing services has contributed to the overall revenue increase.

The shift in Euronext's business model reflects a broader trend in the financial markets, where there is a growing preference for custody and settlement services over traditional cash and derivatives trading. This strategic pivot is aimed at enhancing the company's competitive edge in the evolving market landscape.

Market Trends and Investor Sentiment

Euronext's CEO, Stephane Boujnah, highlighted the changing dynamics in the European market, noting that many global investors are beginning to show renewed interest in Europe. This shift is largely driven by valuation gaps between U.S. and European markets, which are becoming increasingly attractive to investors.

Boujnah pointed out that the integrated market of Euronext is now twice the size of the liquidity pool of the London Stock Exchange, a factor that has influenced major companies' decisions regarding their primary listings. For instance, Unilever recently chose Amsterdam over London and New York for its ice cream business listing, underscoring the growing appeal of Euronext.

Challenges in Attracting New Listings

Despite the positive revenue results, Euronext and other European exchanges have faced challenges in attracting new listings in recent years. Many companies are opting to remain private, while the booming U.S. market continues to lure significant names away from European exchanges. This trend has raised concerns about the long-term competitiveness of European stock markets.

However, the recent uptick in public offerings in Europe suggests a potential turnaround. Euronext's leadership remains optimistic about the future, believing that the current market conditions may lead to increased activity in the coming months.

Conclusion

Euronext's fourth quarter results not only reflect the company's strong performance but also highlight the shifting landscape of the European financial markets. With a strategic focus on fixed income trading and clearing services, Euronext is positioning itself to capitalize on emerging opportunities. As investor sentiment shifts and public offerings begin to rise, the future looks promising for the pan-European stock exchange operator.

Sources