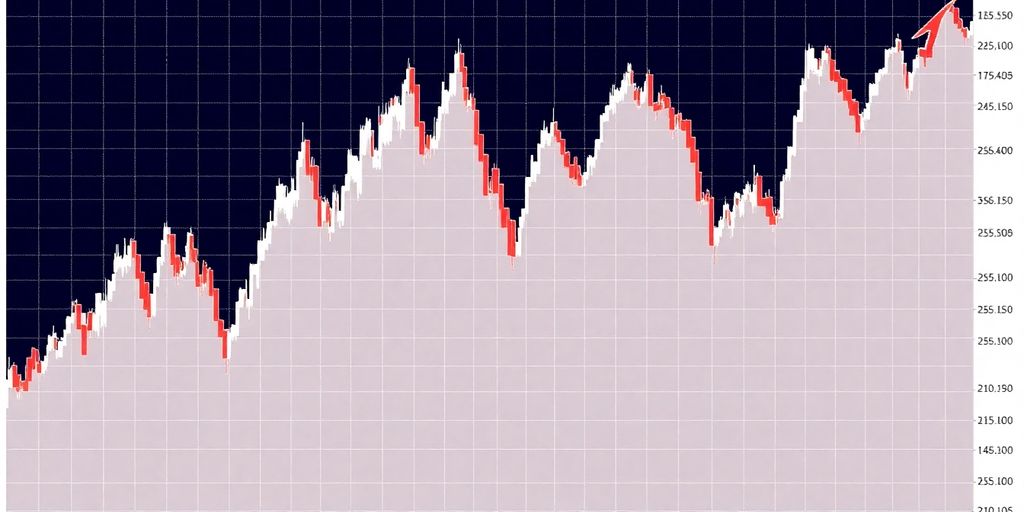

Most major stock markets in the Gulf experienced gains in early trading on February 24, 2025, buoyed by strong earnings reports and significant corporate announcements. However, the Qatari index diverged from this trend, showing a slight decline.

Key Takeaways

- Saudi Arabia's Benchmark Index: Rose by 0.1%, driven by ACWA Power's 2.3% increase.

- ACWA Power's Acquisition: Plans to purchase stakes in assets in Kuwait and Bahrain for $693 million.

- Dubai's Main Index: Increased by 0.3%, led by Empower's 1.2% rise.

- Qatari Benchmark: Fell by 0.4%, impacted by a drop in Qatar National Bank's shares.

Saudi Arabia's Market Performance

Saudi Arabia's benchmark index, known as TASI, edged up by 0.1% in early trading. ACWA Power Company, a key player in the energy sector, saw its shares rise by 2.3%. This increase follows the company's announcement of plans to acquire stakes in energy and water desalination assets in Kuwait and Bahrain, valued at approximately $693 million. The acquisition will enhance ACWA's operational capacity, which includes 4.61 gigawatts of gas-fired power generation and significant water desalination capabilities.

Dubai's Positive Momentum

In Dubai, the main share index climbed by 0.3%, breaking a two-session losing streak. The rise was primarily fueled by a 1.2% increase in shares of Empower, a district cooling services provider. Empower recently signed an agreement with the Dubai Multi Commodities Centre to supply sustainable cooling services for the next phase of Uptown Dubai, further solidifying its market position.

Additionally, Drake & Scull International, a construction and engineering firm, saw its shares advance by 2% after securing contracts worth over 1 billion dirhams (approximately $272.28 million) for the Arabian Hills project.

Abu Dhabi's Steady Gains

Abu Dhabi's index also showed resilience, nudging up by 0.1%. The market's stability reflects a broader trend of positive corporate earnings and strategic announcements across the region, contributing to investor confidence.

Qatari Market Decline

Contrasting the upward trends in other Gulf markets, the Qatari benchmark index fell by 0.4%. This decline was primarily driven by a 1.9% drop in shares of Qatar National Bank, the largest lender in the Gulf region. Despite this setback, Qatar's Prime Minister Sheikh Mohammed bin Abdulrahman Al Thani announced that six venture capital firms, part of the investment authority's "fund of funds" program, will establish offices or regional headquarters in Qatar, indicating ongoing investment interest in the country.

Conclusion

The overall performance of Gulf markets on February 24, 2025, highlights a positive outlook driven by corporate earnings and strategic developments. While the Qatari market faced challenges, the gains in Saudi Arabia, Dubai, and Abu Dhabi reflect a resilient regional economy poised for growth. Investors will be keenly watching upcoming corporate announcements and economic indicators to gauge future market trends.

Sources