Walmart-backed PhonePe is taking significant steps towards its public listing on Indian stock exchanges, marking a pivotal moment for the fintech firm. With a strong financial performance in the past fiscal year, PhonePe is poised to capitalize on the growing interest in initial public offerings (IPOs) in India.

Key Takeaways

- PhonePe is preparing for a public listing on Indian stock exchanges.

- The company reported a profit for the first time in fiscal year 2024.

- Revenue surged by 74% to over 50 billion rupees.

- PhonePe holds a 48.4% share of India's Unified Payments Interface (UPI) transactions.

- The timeline for the IPO has not yet been disclosed.

Financial Performance Highlights

PhonePe, founded in 2016, has shown remarkable growth, particularly in the fiscal year 2024. The company reported:

- Profitability: Achieved a consolidated profit before employee stock options of 1.97 billion rupees, a significant turnaround from a loss of 7.38 billion rupees in the previous year.

- Revenue Growth: Revenue increased by 74%, surpassing 50 billion rupees.

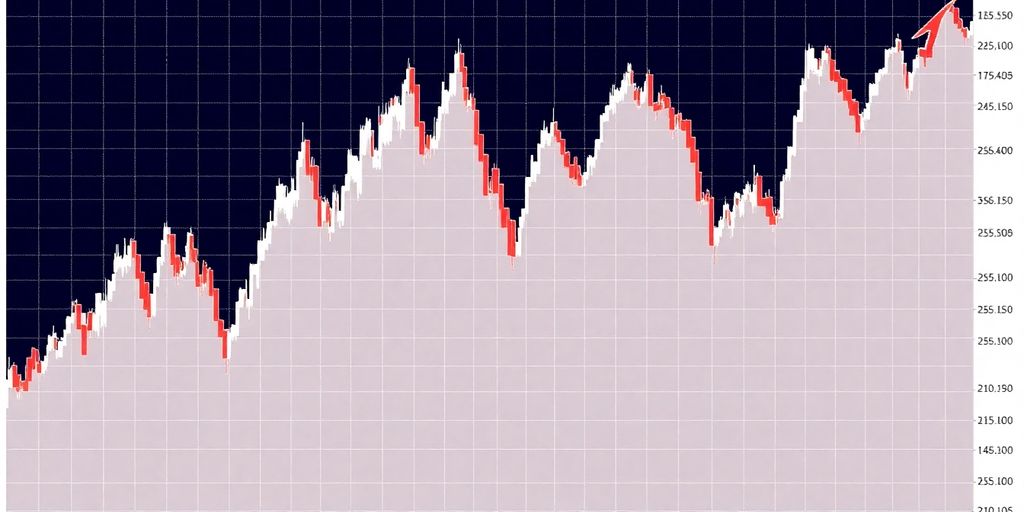

This financial success comes at a time when the Indian stock market has experienced a surge in IPO activity, although recent downturns have affected investor sentiment.

Market Context

The Indian stock market has been vibrant, with numerous companies launching IPOs throughout 2024. However, a downturn since October has created a cautious atmosphere among investors. Despite this, PhonePe's strong performance may attract interest as it prepares for its public offering.

PhonePe's Market Position

PhonePe is a leading player in India's digital payments landscape, particularly through its integration with the Unified Payments Interface (UPI). Key statistics include:

- User Base: Over 590 million registered users.

- Merchant Network: More than 40 million merchants.

- Transaction Volume: Processes over 310 million online transactions daily.

The company's dominance in the UPI space, with a 48.4% market share as of January 2025, positions it favorably for future growth and investor interest.

Competitive Landscape

PhonePe faces competition from other fintech firms, notably Paytm, which filed for a 183-billion-rupee IPO in 2021. Paytm's stock has struggled since its debut, trading significantly lower than its initial listing price. This context highlights the challenges and opportunities that PhonePe may encounter as it moves towards its IPO.

Conclusion

As PhonePe prepares for its stock market debut, the company stands at a crossroads of opportunity and challenge. With a solid financial foundation and a leading position in the digital payments sector, PhonePe's upcoming IPO could be a significant event in the Indian financial landscape. Investors and market watchers will be keenly observing the company's next steps as it navigates this critical phase in its growth trajectory.

Sources