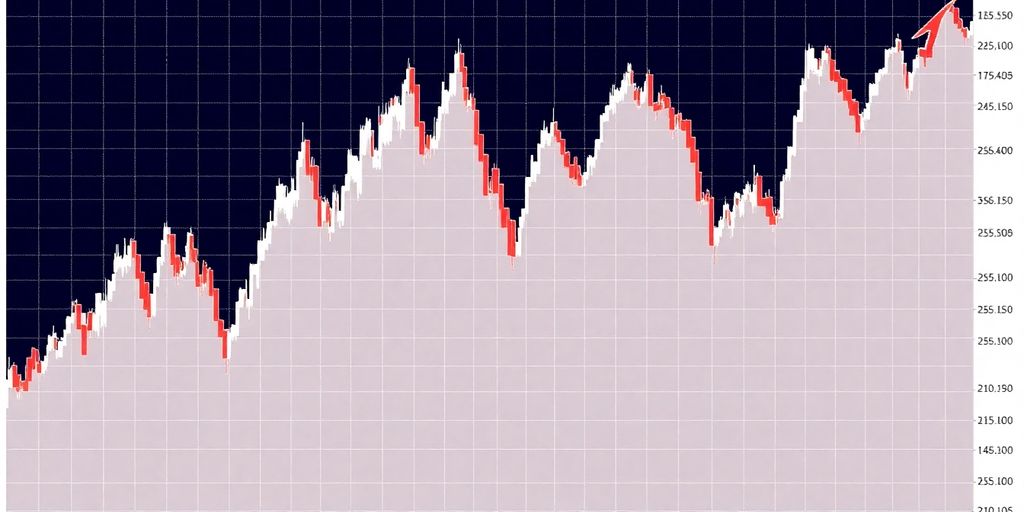

The Toronto Stock Exchange (TSX) experienced its largest drop in three weeks, closing down 1.6% as concerns over a potential trade war and disappointing economic data weighed heavily on investor sentiment. The decline reflects broader market anxieties regarding U.S. tariffs on automotive imports and their implications for the Canadian economy.

Key Takeaways

- TSX composite index fell 401.91 points to 24,759.15.

- The technology sector was the hardest hit, dropping 3%.

- U.S. tariffs on auto imports raised fears of economic slowdown.

- Canadian GDP growth showed signs of stagnation.

Market Overview

The TSX composite index closed at 24,759.15, marking its lowest level since March 18. This decline is attributed to a combination of factors, including:

- U.S. Economic Data: Recent reports indicated that U.S. consumer spending rebounded less than expected in February, while inflationary pressures increased, raising concerns about the economic outlook.

- Trade War Concerns: President Trump’s announcement of a 25% tariff on imported vehicles has heightened fears of a trade war, particularly affecting Canada, where automotive exports are significant.

Sector Performance

The decline in the TSX was broad-based, with several sectors experiencing significant losses:

- Technology Sector: Down 3%, with Shopify Inc. falling 5.7%.

- Materials Sector: Dropped 1.7%, impacted by a 15.8% decline in Aya Gold & Silver Inc. shares.

- Consumer Discretionary: Fell 2.2%, with auto parts suppliers and Restaurant Brands International losing ground.

- Industrials: Also down 2.2%, as railroad shares declined.

- Financials: Heavily weighted financial stocks ended 1.6% lower.

Economic Implications

The economic landscape is becoming increasingly uncertain:

- GDP Growth: While Canadian GDP rose by 0.4% in January, preliminary estimates for February suggest stagnation, raising concerns about the sustainability of growth.

- Tariff Impact: The automotive sector, crucial for the Canadian economy, is bracing for potential retaliatory tariffs from Canada in response to U.S. measures.

Investor Sentiment

Market analysts express concern over the volatility created by the ongoing trade tensions. Matt Skipp, president of SW8 Asset Management, noted, "When the president of the United States tries to shut down the global economy, it can be problematic for stock markets."

As investors navigate this turbulent environment, the focus will remain on upcoming economic data and any developments regarding U.S. tariffs. The uncertainty surrounding trade policies continues to loom large, influencing market dynamics and investor strategies moving forward.

Sources